Lending Resources

Blogging About Residential and Commercial Property Loans in Southern California

Has your dream always been to have your own restaurant? If you've finally decided to establish yourself as a chef with your own restaurant, you may find it difficult to finance your business. This is because restaurants are often considered high-risk investments by banks. Restaurants are thought of as high-risk because of the stress that is put on the owners as running a restaurant is often a job that lasts far longer than the average working hours.

California private money lenders have been busy recently with a new kind of individual who flips houses. We're all much too familiar with the quintessential hipster -- the effete individual with a taste for music that you've never heard of -- but a small group of these counter-culture intellectualists has broken into a new market.

Debt is a four letter word that instills fear into the hearts of many. Unfortunately, debt is very easy to acquire, and before you know it you can feel consumed. Know you are not alone, as the latest statistics from the Federal Reserve indicate that the consumer debt in the United States continues to regularly increase, as it reached almost $3.4 trillion in May 2015.

Searching for a great hard money lender can be a challenge, especially if you're not too familiar with hard money loans to begin with. But even if you aren't familiar with hard money loan rates and rules, it's important that you work with private hard money lenders who do.

Read more: Important Red Flags to Look Out for When Selecting a Hard Money Lender

If you are looking to take out a hard money loan, it is important that you do the proper research before choosing a private hard money lender. While hard money loans can be expensive, considering they have lower loan-to-value ratios and high interest rates -- potentially 12% or higher -- they can be considerably helpful in securing real estate deals. But before you sign on the dotted line, here are some questions to ask those potential hard money lenders.

Read more: 5 Questions to Ask a Potential Hard Money Loan Lender

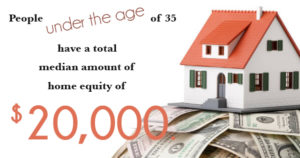

Buying a new house is intimidating, especially for first time home buyers. There are so many choices and boxes that need to be checked off in the process of searching that most people think the work is over once they've made a purchase. Then there's talking to banks or private lenders. A smart home owner knows that there's something else left to do besides moving in, and that's to start building equity.

Read more: How Building a Home Equity can Mean Putting Your Child Through College

If you have bad credit or are looking for a non-traditional way of securing real estate, hard money loans can be quite beneficial. These loans are granted by a private hard money lender and are often seen as a mortgage alternative. Hard money is a great route to take in today's rough economic situation, but it is incredibly important to understand the process before you sign on the dotted line. Here are some important facts you must know about hard money lenders and loans.

Read more: What You Didn't Know About Hard Money Loans, Explained

Are you interested in the hard money loan process, but aren't sure where to start? Here's what you need to know.

What exactly is a hard money loan?

A hard money loan is one that is secured by real estate. These private hard money lenders typically charge higher rates than banks. However, these lenders accept borrowers who've been denied from many financial institutions. In other words, if you can't seem to get a loan, a hard money lender may be the place to go.

Read more: Frequently Asked Questions Concerning Hard Money Loans: Part 1

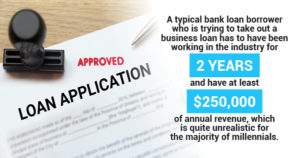

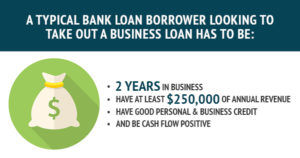

There's no shortage of individuals or organizations that are willing to lend money to your business, no matter what your qualifications may be. These can be traditional bank lenders, private money lenders, or alternative financing companies. they may all have different names, but they're all willing to give small business owners like you a leg up.

A hard money loan is a short-term mortgage that can be used for investment properties. They offer many advantages like being able to be obtained quickly and having more flexible qualifications. This type of loan is generally used by both short-term and long-term investors. With that in mind, this article is going to discuss the most common types of people who invest in hard loans.

Read more: These 3 Types of Investors Often Utilize Hard Money Loans

Private money lenders can be helpful if you have a major project that needs funding. They can give you the money that you need to be able to successfully fulfill your requirements, which you will one day pay back.

Read more: 3 Ways to Find Private Money Lenders Who Will Fund Your Deal

There are so many financial aspects of hard money loans, they can be quite difficult to understand. If you aren't exactly sure how does a hard money loan work, you've come to the right place.

How Does a Hard Money Loan Work?

Read more: How Does a Hard Money Loan Work? 4 FAQs Explain How

Private hard money lenders in California can help you get around some otherwise difficult financial situations. If you're trying to invest, real estate can be a great way to use your money, but many people aren't always comfortable paying a significant amount of cash up front. Dealing with a private hard money lender who can provide you with a hard money loan might be your best bet.

Read more: 3 Great Benefits of Using Hard Money Loans to Invest in Property