Lending Resources

Blogging About Residential and Commercial Property Loans in Southern California

Finding the right mortgage can be an extremely draining task if you don't know all the facts up front. Should you opt for a mortgage loan, whether a private loan or backed by a bank, there are some common misconceptions that add to the confusion. Not knowing the full spectrum of your loan can mean failing to make payments and getting into debt. According to the Federal Reserve, consumer debt in the U.S. reached almost $3.4 trillion in May 2015 and continues to increase. Don't become a statistic, if you know the truth behind these three myths walking in, then you'll be ready to go.

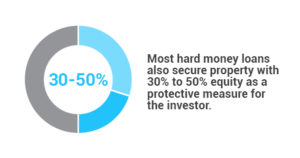

There are plenty of images that come up when someone thinks of both hard money loans and hard money lenders. Since there is a lot of skewed information out there about hard money loans, we have broken down everything about this process so no one is left out in the cold.

Read more: All About Hard Money Loans : What a Beginner Needs to Know

Hard money loans can be great for people who are looking to purchase various kinds of properties. Though you should be sure that your finances are in order and you can stick to a realistic budget when working with private lenders, these hard money loans can make it much easier to make an offer on a building or home.

Read more: 2 Ways to Use Hard Money Loans for Real Estate Investments

It's no secret that hard money loans are a viable options for those in need of quick cash. A typical bank loan borrower looking to take out a business loan has to be two years in business, have at least $250,000 of annual revenue, have good personal and business credit, and be cash flow positive. Still, hard money loans are incredibly versatile in a variety of situations. But before you commit to a hard money loan, it's important to be aware of these common mistakes.

Read more: Considering A Hard Money Loan? Beware Of These Common Mistakes

House flipping is becoming extremely popular as it can help you create an income while giving someone else the home of their dreams. House flipping is on TV all the time with a growing number of house flipping-themed shows on the daily reality lineup.

If a home sells at least twice in the same year, it's considered house flipping. House flipping strayed from the spotlight for a little while, but now it's coming back in a big way. In fact, house flipping made up 6.1% of all U.S. home sales in 2016.

Read more: House Flipping is Coming Back to California in a Big Way

It's no secret in the world of real estate that using hard money loans can be a smart and profitable way to fund your investments. Real estate is a field that requires substantial capital to get started, and many people simply don't have access to that kind of money. For instance, a typical borrower looking to take out a business loan from a bank would need to have already been in business for two years with at least $250,000 in annual revenue. More than that, they'd also have to have good business and personal credit scores with a positive cash flow.

Read more: 3 Types of Real Estate That Could Benefit From Hard Money Loans

If you've worked in the lending industry or the house flipping business before, you're probably already familiar with the concept of a hard money loan. You also probably know what the difference between a hard money loan and a private money loan is. But for those not quite in the know, it can be a little confusing.

Read more: Hard Money Loans: A Guide to Understanding the Basics

If you are considering applying for a hard money loan, there are a few things you must know about the process. Before you contact a private hard money lender, here is everything a beginner should know about getting started with hard money loans.

Read more: Interested in Hard Money Loans? Here's What You Should Know Before Applying

One of the most popular forms of financing for real estate investors, without a doubt, is the hard money loan. But what makes hard money loans so highly sought-after? There are numerous reasons why real estate investors like working with hard money lenders, but chief among them are the fact that these loans are fast, flexible, and carry more weight. Below, we'll take a closer look at just three of the reasons why investors like working with hard money lenders, in particular.

Read more: Top 3 Reasons Why Real Estate Investors Like Hard Money Loans

Buying real estate property may not always be easy. If you find yourself looking to purchase property, but don't have the money to do so, many people often turn to hard money loans for assistance.

Read more: 3 Reasons Your Hard Loan Application May Be Declined

If you work in real estate, particularly flipping houses, then you're probably familiar with hard money and private money lenders. In this industry, knowing how they operate and where to find them is essential. But for newcomers to the house flipping industry, finding those resources might not come easily. For example, knowing where to go to find private money lenders or how to spot good private money loans are both skills learned with time. To save some of that time for you, we've created a short guide to help you learn how and where to find private money lenders.

Is there something you are wanting to do, but you don't have the money for it? You want to update your kitchen. Maybe you want to build an extension on your house. These things can get very expensive.